Warren buffet said :-

Do not save what is left after spending, but spend what is left after saving.

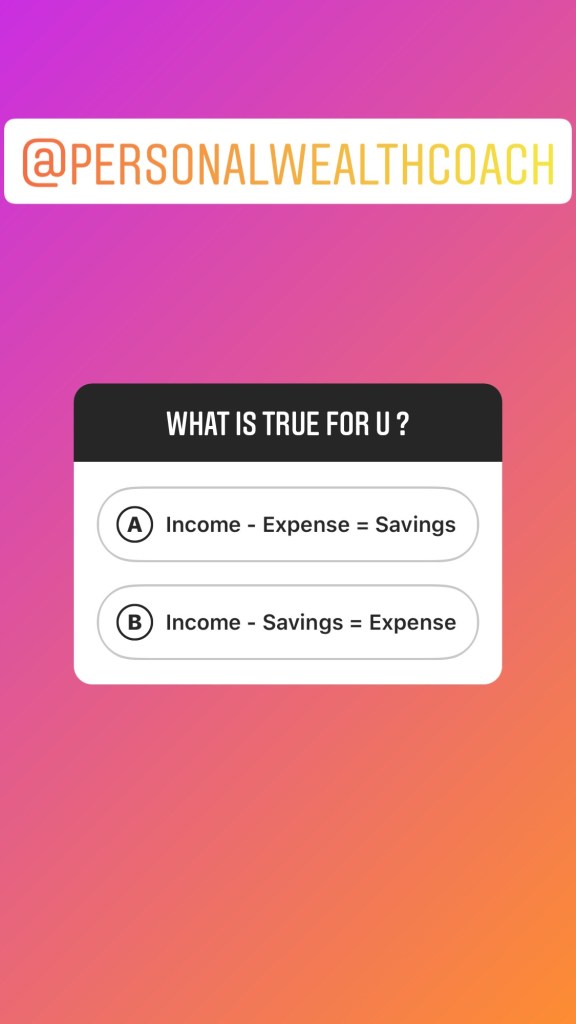

In the poll we took :-

90 % of the people said that for them Income – Expense = Savings.

Agreed the cost of living , peer pressure, social status etc have all pushed savings to the edge.

Experts say ideally 30% of your take home income should be saved. While I believe taking small steps would lead to big achievements. A minimum of 10 % of your monthly income set aside would fetch you an amount more than your monthly take home at the end of the year .

Eg:- Your Monthly income is 10,000 (please substitute this figure with your actual earnings )

Keep 10% aside , in this case it would be 1000 pm. While you would have 90% to spend

By the end of 12 months this compulsory set aside of 10% pm would fetch you at least ₹12000 which is more than your monthly take home .

While there is no end to the needs & desire list.

The solution is in the problem itself .

Make savings a compulsion instead of a choice.

Make Savings your One Big Bad Habit.